Value = Income / Risk

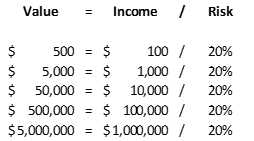

That is a very simple formula. The math can be done on any calculator, and the result is easy to understand. Unfortunately, the variables themselves are not always so easy. More on this later. Most people understand that in order to increase the value, one simply has to increase the amount of Income in the numerator or decrease the amount of Risk in the denominator. Below is a very simple example of this concept:

As the income increases, so does the indication of value.

Now, back to the variables in this very basic formula. There are many methods available for determining the risk rate for various income streams, but one of the more commonly used methods is called the Build-up method. The Build-up method is a simplified version of the CAPM (Capital Asset Pricing Model) which is used in the financial analysis of publicly traded companies. The basic application of the Build-up method is to add up several different risk rates, most of which come from an analysis of the publicly traded market, until one has a risk rate commensurate with the estimated risk of the operations of the subject company, less a long-term sustainable growth rate.

The key to the application of this basic formula described above, is to use an income stream that matches that of the analyses used to develop the risk rate. In private company valuation terms, this income stream is known as the dividend paying capacity of the company. The ‘capacity’ is what is important, rather than the actual dividends paid, as most privately held companies do NOT pay dividends. The dividend paying capacity of a company has also been described as its net cash flow, or the amount of cash that could be removed from the business’ operations without negatively impacting operations.

Imagine what would happen to the indicated value of the Company, if an appraiser used a larger, perhaps even a pretax income stream like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)? The indicated value would be higher, but it would also be wrong as EBITDA does NOT represent the amount of cash that could be removed without negatively impacting operations. Imagine what the future would hold for a Company that never paid its income taxes or interest expenses.

Valuing a privately held company involves many steps and analyses. Be mindful of matching the appropriate income stream to the selected risk rate. Mixing these variables is not a good idea.

Recommended Reading

- Use the Correct Income Stream

- What Do the Financials Actually Tell Us?

- Unlocking Hidden Income and Assets

- Normalizing Adjustment – Rent

- Valuing a Small Business in its Startup Phase

- What Does a Business Appraisal Cost?

- Analysis Shmalysis

Recommended Resources

Recommended Courses

ISBA Learning: Looking for authoritative business appraisal courses, tools, webinars, and more? Stop trying to create resources from scratch and start taking advantage of having exactly what you need right at your fingertips in ISBA Learning.